Wondering why companies ask you to confirm your identity? KYC (Know Your Customer) verification is a key step toward ensuring the security of your data or transactions. Find out the benefits of this process and why it is so particularly important.

KYC verification - what is it?

KYC verification is an important process in the financial industry, but not only. Its purpose is to confirm the identity of the customer. It reduces the risk of fraud and money laundering, while increasing the security of the entire transaction. As part of the procedure, customers are required to provide the company with documents confirming their data. These may include:

- ID card,

- passport,

- driver's license.

The purpose of KYC verification is to obtain assurance that the people who use a company's services are who they say they are. This significantly increases the level of trust in the organization's relationship with the customer.

Why is the KYC process so important?

The Know Your Customer procedure plays a major role for several reasons. Verifying the identity of customers helps prevent fraud, money laundering and terrorism financing. Financial institutions or regulatory organizations place great importance on this.

The KYC process helps protect companies from the risk of working with individuals involved in criminal activities. Thus, verification naturally enhances the security of a company's entire financial system.

KYC is also a way to build a lasting and trusted relationship between customers and the institution. The former, by going through the verification process, are assured that their data will be used in accordance with the law. For the institution, on the other hand, knowing its customer base means a chance to better tailor its offer to their needs and expectations. KYC verification also provides a method for monitoring possible suspicious transactions about which there is uncertainty.

It is worth remembering that in some countries compliance with KYC standards is an obligation and a legal requirement. Organizations that neglect it risk heavy fines and other consequences. In this context, KYC helps to comply with regulations and preserve a company's reputation.

How does the KYC process work?

KYC verification takes place in several stages. Its goals are to accurately confirm the customer's identity and assess potential risks associated with the customer's activities.

Step 1: Gather information

At the beginning, the customer is asked to provide basic personal information.

This includes:

- full name,

- date of birth,

- address of residence, nationality,

- telephone number.

It is common for a client to also be asked for information about sources of income or/and source of funds.

Step 2: Provision of documents by the customer

In order to confirm identity, the customer must submit one of the documents to prove it. The document is scanned or photographed and then sent for verification.

Step 3: Document verification

The verification team carefully analyzes the data. It uses special tools for this purpose, which automate the entire process. Verification includes, among other things, assessing the authenticity and conformity of the information contained in the documents.

Step 4: Risk analysis

The obliged institution then conducts a risk assessment of the specific customer. Its profile and financial history are taken into account. Sometimes this is done using registers and databases.

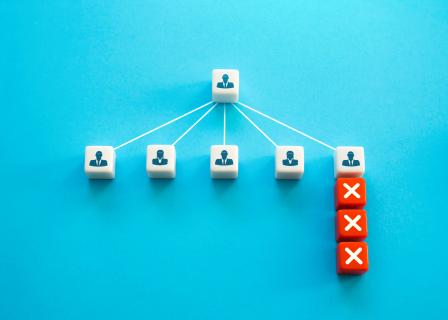

Step 5: Approval or rejection

Finally, the institution decides whether to approve or reject the customer's application. If the result of the verification is successful, the customer will be able to use the company's full offer. If it is denied, he will receive appropriate information about the decision. He may also be asked to provide additional documents or information.

Step 6: Monitoring

The financial institution is obliged to constantly monitor customers. This allows it to detect worrying signals in real time and update the information in its system. Regular risk assessment is essential to maintain a high level of security in the company.

Why is identity verification necessary for KYC?

Implementing KYC solutions brings a number of benefits to a company that go well beyond regulatory compliance. This type of procedure is worth investing in to:

- enhance the internal security of the organization,

- build trust in customer relationships,

- maintain business compliance with legal regulations,

- optimize customer and document verification processes,

- manage risks more effectively.

Investing in professional KYC verification is a strategic decision. It brings long-term benefits to the entrepreneur.

Examples of KYC application in various industries

KYC verification can be successfully implemented in various sectors and industries. In the case of banking and finance, it is a cornerstone. Through the procedure, financial institutions prevent acts of terrorism and protect themselves from working with fraudsters. Before a potential customer applies for a bank account, a loan or a major transaction, he or she will have to provide a number of documents proving his or her identity.

KYC is also being used by players in the insurance market. In this way, they can more easily assess customer risks and prevent fraud or policy scams. Verification occurs before an insurance contract is signed.

Another area where the KYC process is applicable is FinTech, or financial technology. This includes online payment platforms or cryptocurrencies.

In the case of the FinTech industry, solutions such as artificial intelligence and biometrics are being used to verify customers.

KYC is a familiar topic for e-commerce entrepreneurs as well. The implementation of the procedure is aimed at preventing payment fraud and protecting customers' identities. The risk of phishing is considerable, especially for large online transactions.

Know Your Customer plays an important role. It is a strategic tool for data protection, risk and financial data management. Therefore, it is advantageous to become acquainted with it and implement it.